Month-end flux refers to financial variances that occur during the month-end close process. Finance teams analyze these fluctuations by comparing current period results to prior periods or budgets to identify significant changes, errors, or trends that impact decision-making and financial accuracy.

Every Controller knows the moment. You pull the preliminary financials, scan the P&L, and there it is: a variance that makes you pause. Revenue jumped 18% but you weren't expecting that. Marketing spend dropped when the campaign was supposed to ramp up.

These unexpected fluctuations are month-end flux, and they represent one of the most time-intensive activities in the close process. Understanding what drives these variations, investigating their root causes, and explaining them clearly to stakeholders consumes hours of the finance team's capacity every single cycle. Yet this work is non-negotiable. Management needs answers. Auditors expect documentation. Board members want confidence that the numbers tell the real story.

The challenge isn't just identifying that differences exist. The real work lies in understanding why they happened, whether they signal something that requires action, and how to manage this process without letting it consume your entire close cycle.

What Causes Month-End Flux

Financial variances during close emerge from multiple sources, and experienced Controllers learn to distinguish between normal business fluctuations and red flags that demand deeper investigation.

Timing Differences

Accruals that don't materialize as expected, revenue recognition adjustments, and period cut-off issues all generate variances. A large prepayment in one month creates a spike that reverses in the next. Quarter-end incentives concentrate in specific periods.

Volume Changes

More customer invoices mean higher revenue. Seasonal hiring drives up payroll. A successful marketing campaign generates increased leads and corresponding expenses. These variances tell the story of business growth or contraction.

Operational Changes

Pricing adjustments shift revenue per transaction. New product launches change the cost structure. Reorganizations move expenses between departments.

System and Process Issues

Transactions coded to the wrong account require reclassification. Manual journal entries correct errors from automated processes. Multi-entity operations surface intercompany discrepancies that need resolution.

External Factors

Currency fluctuations impact companies with international operations. Market conditions affect investment valuations.

You might also like: How to Handle Currency Consolidation in Multi-Entity Organizations

The critical insight is that flux itself isn't inherently problematic. Financial statements should reflect real business activity, which naturally varies from period to period. The challenge for accountants is separating meaningful signals from routine noise.

Why Month-End Flux Analysis Matters

Finance teams investigate fluctuations because accurate variance analysis serves multiple critical business functions simultaneously.

Management Reporting

When executives review monthly results, they need more than numbers. They need to understand what changed, why it changed, and whether the change aligns with strategic expectations.

Audit Readiness

Auditors expect finance teams to understand their numbers at a detailed level. Unexplained fluctuations raise questions about control environments and data accuracy.

Explore more on this topic: AI in Audit: Automating Reconciliations and Financial Reporting

Operational Insight

Flux patterns reveal business trends before they become obvious. A gradual increase in customer acquisition costs might hide in aggregate marketing spend. This analysis forces finance teams to look at transaction-level detail.

Budget Management

Teams need to understand not just whether they hit targets, but why they missed or exceeded them. A favorable variance might result from delayed hiring rather than improved efficiency.

The fundamental value of flux analysis lies in transforming raw financial data into actionable business intelligence.

The Traditional Approach to Managing Month-End Flux

Despite advances in financial technology, most Controllers still rely on manual processes that have remained largely unchanged for decades.

Professionals export trial balance data from the ERP into Excel spreadsheets. They build calculations comparing the current period to the prior period, or actual to budget, across hundreds of general ledger accounts. They apply materiality thresholds to filter which fluctuations deserve investigation.

Then the real work begins; for each material variation, someone must drill into the account detail, reviewing individual transactions to identify what drove the change. This means switching between systems, pulling transaction reports, scanning for unusual items, and manually documenting findings.

Once the investigation is complete, the finance team writes narrative explanations for each variance. These explanations must be clear enough for non-financial executives, detailed enough to satisfy audit requirements, and professional enough for board packages.

Leadership reviews all commentary, requests clarifications, and edits for consistency. Finally, the analysis gets formatted into management reports.

This process typically consumes between seven and twelve hours per close cycle. The work happens at the most time-pressured phase of close, when the finance team is already stretched managing reconciliations and journal entries.

How Modern Finance Teams Handle Flux

Forward-thinking Controllers are rethinking flux analysis by applying the same automation principles that have transformed other parts of the close process.

Automated Variance Detection

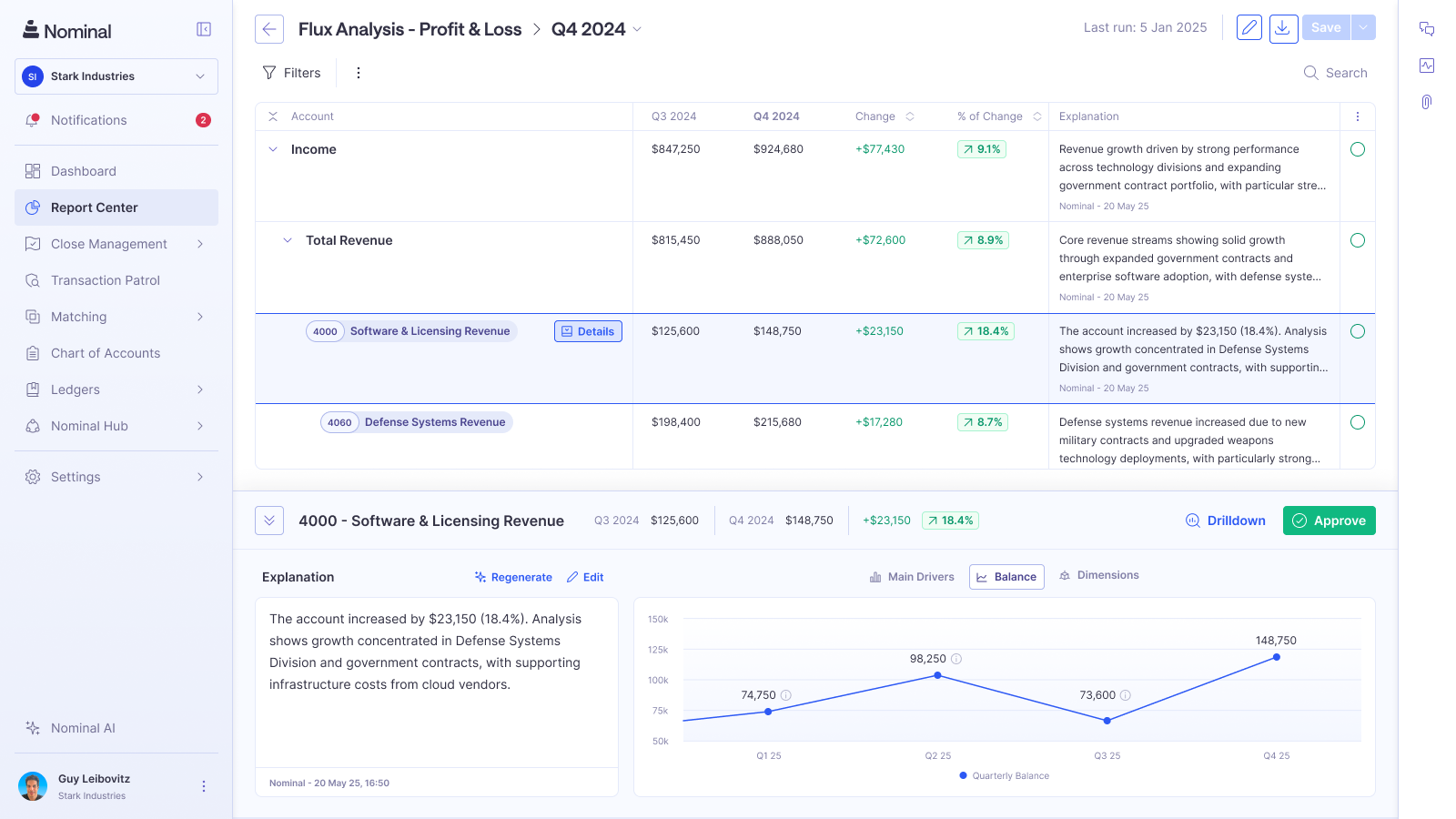

Platforms like Nominal continuously monitor financial data and automatically flag material fluctuations based on configurable thresholds. Rather than waiting until month-end to calculate changes in spreadsheets, teams get real-time visibility into emerging flux across all accounts, entities, and dimensions.

This approach catches issues earlier in the close timeline, when there's still time to investigate without deadline pressure. It also ensures comprehensive coverage where manual processes inevitably miss discrepancies.

For a deeper dive, check out: Month-End Close Automation: How AI Is Transforming Finance Operations

Transaction-Level Investigation

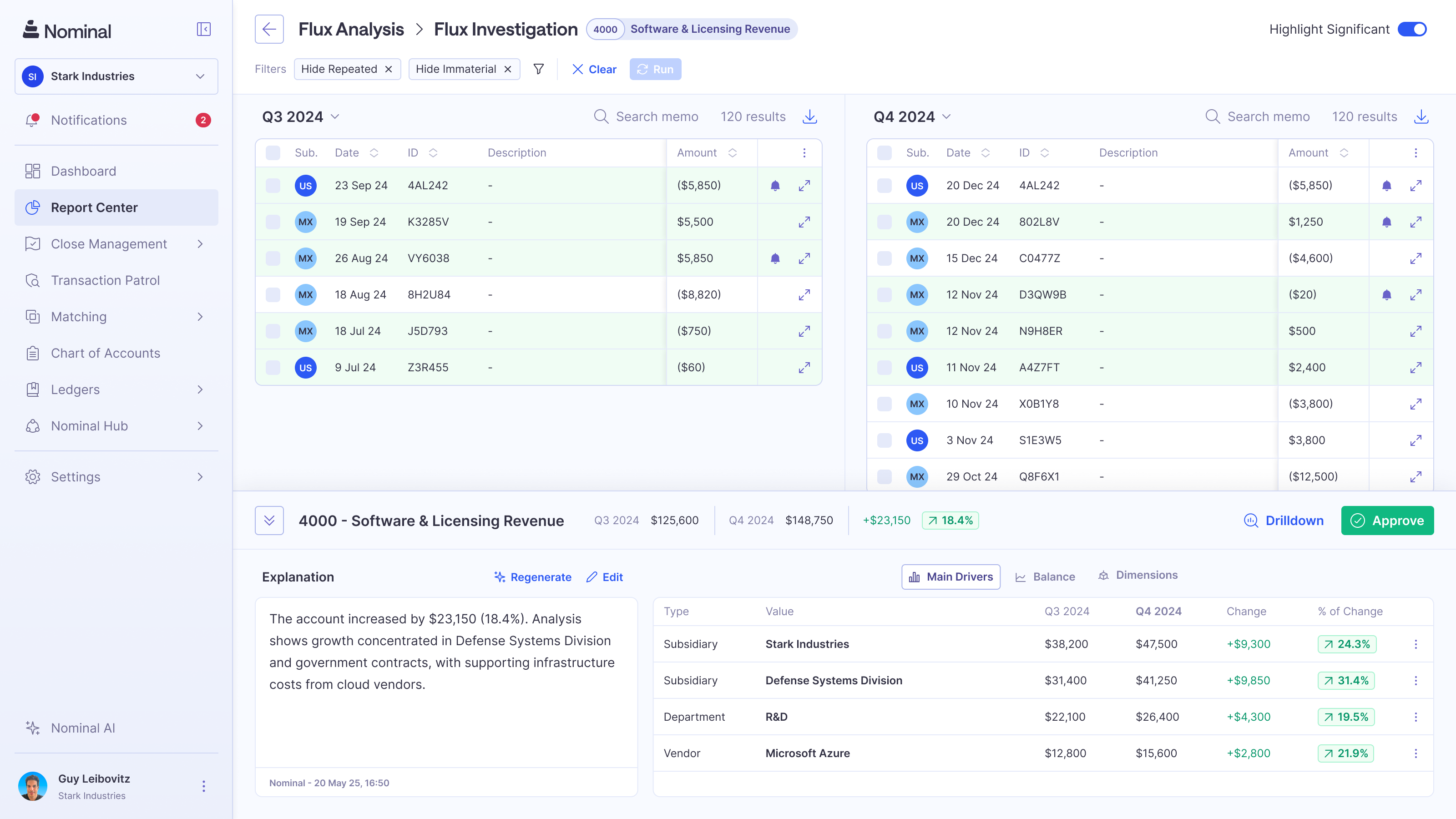

The real breakthrough comes from platforms that provide direct access to underlying transaction details. When a fluctuation appears, accountants can drill directly into the transactions that drove the change without switching between systems.

This transaction-level visibility enables precise identification of drivers. Instead of explaining that "legal expenses increased," teams can specify that the change resulted from three specific invoices: a trademark filing for $15K, litigation support for $28K, and contract review for $12K.

The capability becomes even more valuable in multi-entity environments where flux might have complex drivers spanning multiple legal entities and currencies.

AI-Generated Explanations

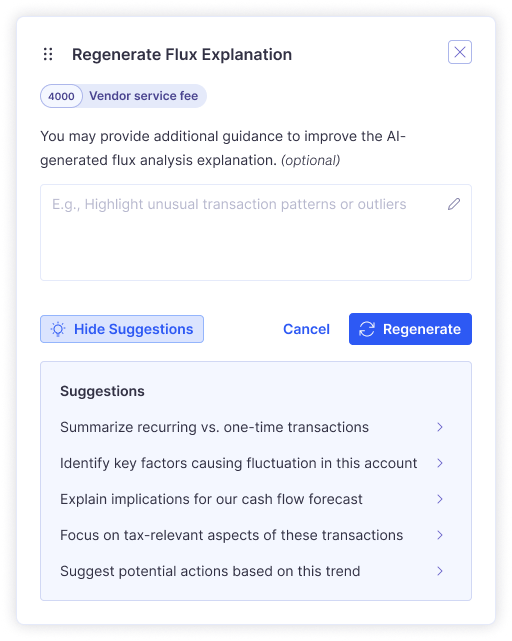

The most transformative development in flux management is AI that generates natural language discrepancy explanations backed by actual transaction data. Rather than starting from a blank page every month, they receive draft explanations that identify what changed, quantify the impact, and cite specific transactions.

These AI-generated narratives maintain consistent quality and professional tone across all fluctuations. The system doesn't suffer from writing fatigue or take shortcuts under deadline pressure.

Critically, this technology works within a human-in-the-loop framework. Finance teams review generated explanations, add business context that algorithms cannot infer, and approve final commentary

Teams using this approach report reducing variance analysis time from eight to twelve hours down to forty-five to sixty minutes per close cycle.

Best Practices for Month-End Flux Management

Whether using manual processes or automated platforms, certain practices improve analysis effectiveness.

Set clear materiality thresholds upfront

Define what constitutes a material fluctuation worth investigating. Typical thresholds combine percentage change with absolute dollar amounts.

Document common drivers for your business

Every company has recurring flux tied to normal operations. Quarter-end sales incentives and seasonal staffing patterns appear predictably in specific periods.

Build investigation time into the close schedule

This analysis cannot be rushed. Budget adequate time for drilling into unusual items and validating explanations.

Focus on controllable versus uncontrollable factors

Not all fluctuations require action, but stakeholders want to know which ones represent opportunities for intervention.

Link insights to forward-looking actions

The most valuable analysis identifies implications for future performance and suggests specific actions.

Controllers who position flux management as strategic intelligence rather than compliance documentation gain influence within their organizations.

Moving Beyond Manual Flux Management

Month-end flux analysis will always require finance judgment and business context. The numbers tell only part of the story, and experienced accountants add insight that no automation can replicate. But the mechanical work of calculating changes, investigating transactions, and writing explanations can and should be automated.

Modern finance teams are moving away from spreadsheet-based processes toward platforms that detect material fluctuations automatically, provide transaction-level drill-down capability, and generate natural language explanations. This shift doesn't eliminate the Controller's role. It elevates it by removing repetitive work and creating capacity for strategic analysis.

The question for finance leaders isn't whether to improve flux management processes. The question is whether to continue accepting that this work consumes ten or more hours every close cycle, or to redirect that time toward activities that drive genuine business value.

Book a demo and see how Nominal automates variance analysis and reduces month-end flux work from hours to minutes.

.jpg)