Agentic Performance Management is a new model for finance that uses autonomous agents to execute complete accounting workflows. It helps finance teams close faster, reduce manual work, and scale operations without adding headcount, enabling leaders to focus on analysis and strategy instead of repetitive execution.

Finance teams today face a paradox. Expectations for speed, accuracy, and strategic insight have never been higher, yet resources remain fixed. Controllers and CFOs are under constant pressure to deliver faster closes, real-time visibility, and error-free reporting while managing increasingly complex operations. Traditional automation helped for a while, but the gains have plateaued.

The problem is not effort or talent. It is architecture. Most finance systems were designed to record and report, not to act. Even advanced automation tools still depend on human intervention at every step, from reconciliations to consolidations to variance explanations. This leaves teams trapped between manual workload and limited automation, spending valuable hours managing processes that never truly run on their own.

A new operational model is emerging to address this gap. Agentic Performance Management brings autonomous execution to finance, allowing intelligent agents to manage accounting workflows from start to finish. Instead of simply assisting humans, these systems execute continuously, learn from outcomes, and improve over time. The result is faster closes, fewer bottlenecks, and a finance function that operates with the same reliability as any other business infrastructure.

What Is Agentic Performance Management?

Finance leaders are operating under growing pressure. Boards expect faster month-end closes, more accurate reporting, and constant audit readiness, while teams are already stretched across manual reconciliations and intercompany eliminations. Traditional fixes, such as hiring more people or extending deadlines, no longer scale.

Agentic Performance Management (APM) offers a new path forward. It represents a structural change in how financial operations run, replacing static automation with systems that can act autonomously. Instead of tools that assist accountants or automate isolated tasks, APM deploys agents that execute entire workflows from start to finish.

These agents operate continuously, monitor data in real-time, and resolve exceptions without waiting for instructions. They reconcile transactions, prepare eliminations, and close the books with the same judgment an experienced accountant would apply, only faster and without fatigue.

.jpg)

Why Traditional Finance Automation Has Stalled

For years, finance leaders have turned to automation to ease workload. Yet most solutions only shift where the work happens rather than remove it.

RPA breaks under pressure

Robotic process automation performs well in static environments but fails when data formats or systems change. Each exception still requires a human to step in, creating new maintenance work instead of efficiency.

AI assistants still depend on human input

Generative AI tools can draft summaries or respond to queries, but they cannot execute. They suggest and assist, leaving approvals, reconciliations, and postings to humans.

Workflow automation only rearranges steps

Routing approvals or digitizing checklists speeds coordination, but does not eliminate manual accounting. Someone still must complete the reconciliation, prepare the journal entry, and verify balances.

These approaches make processes slightly faster, not fundamentally better. Finance teams need technology that does the work, not technology that helps them do it faster.

Explore more on this topic: Breaking the CFO's Impossible Triangle: Speed, Accuracy, and Cost

How Agentic Performance Management Works

Agentic Performance Management introduces autonomous execution into finance. It is the first operational framework where agents perform accounting tasks independently, allowing teams to govern outcomes instead of managing every detail.

An AI agent in this model owns the workflow it supports. It validates transactions, identifies discrepancies, and performs reconciliations or consolidations without external prompts. When exceptions occur, it applies logic based on context and historical behavior to resolve or escalate them appropriately.

The result is a shift from assistance to execution. Accountants still provide oversight and governance, but the agent completes the operational work that once consumed entire teams.

From Assistance to Execution

A conventional AI assistant might highlight a variance in bank reconciliations and suggest possible matches. Under APM, an agent performs the reconciliation itself. It matches transactions, identifies exceptions, posts correcting entries, and documents the results. The accountant reviews and approves the outcome, not each individual step.

This transition defines the difference between automation that supports and automation that acts. It is not about replacing expertise but elevating how that expertise is applied.

How APM Works in Finance Operations

Agentic Performance Management applies across core accounting workflows, delivering efficiency and consistency throughout the close cycle.

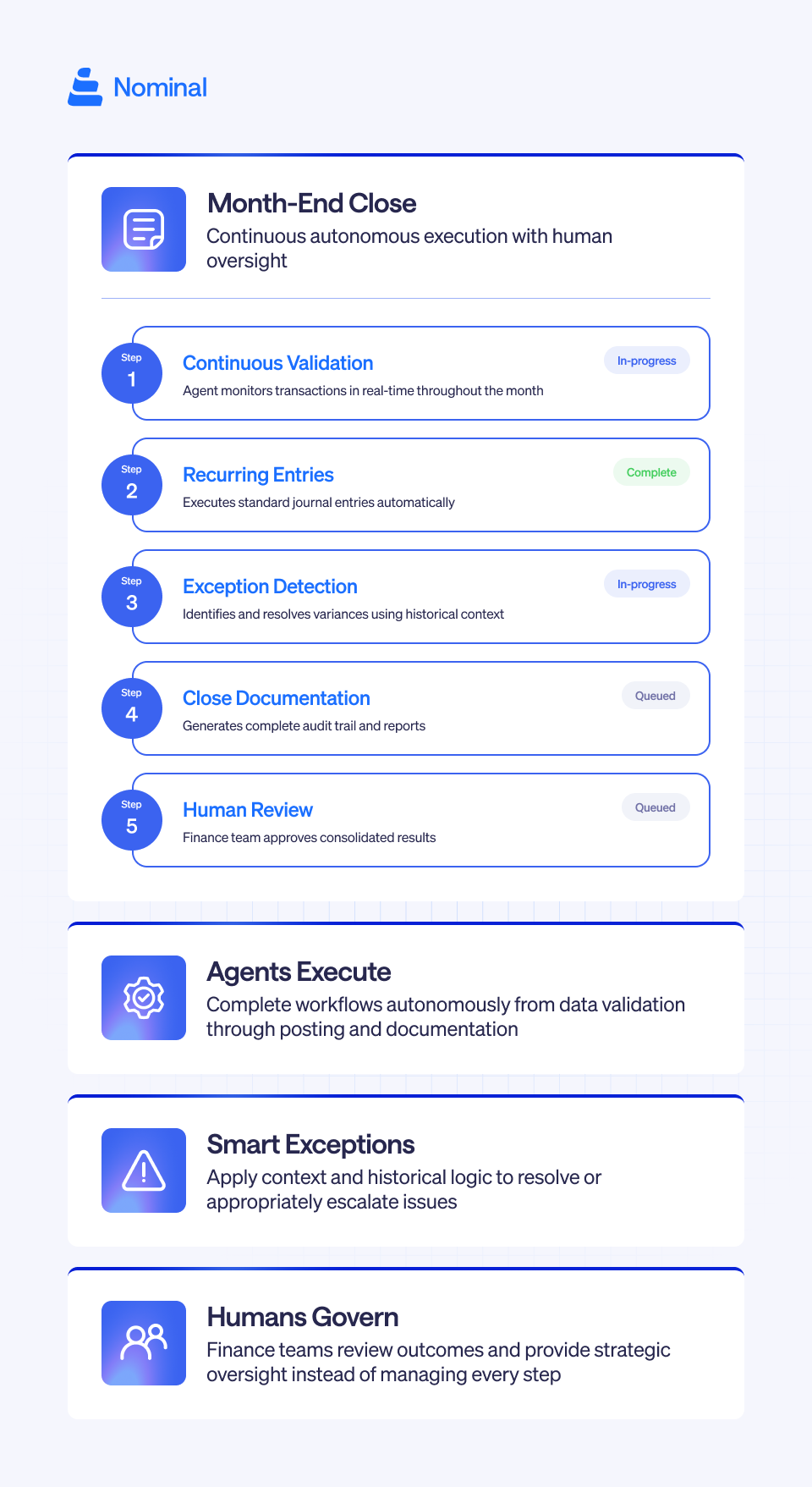

Month-End Close

Instead of dedicating entire teams to the month-end close process, autonomous agents manage the process for each entity. They validate transactions continuously, execute recurring journal entries, and produce close documentation in real-time. Finance teams handle exceptions and review results rather than spending days gathering data.

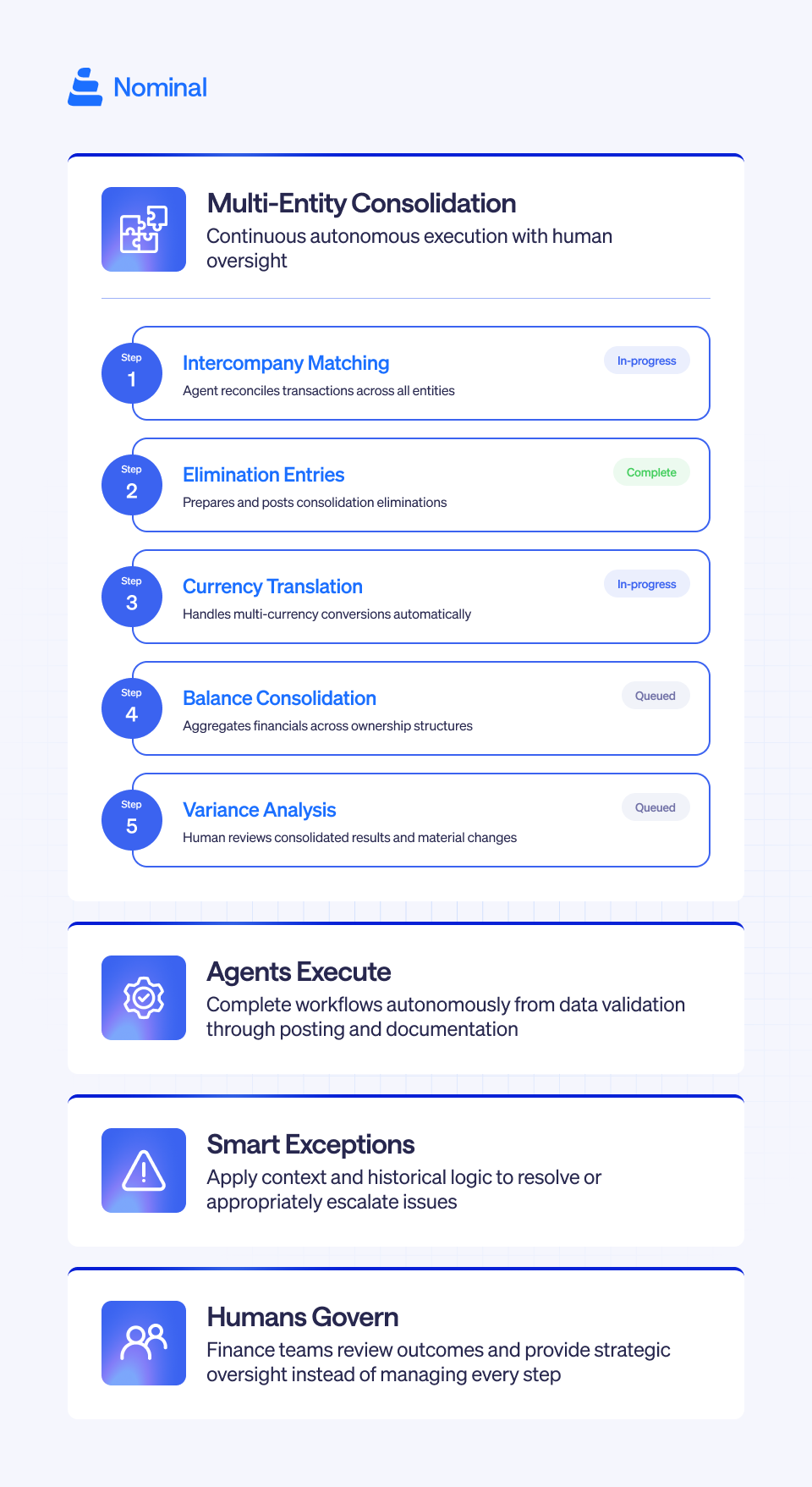

Multi-Entity Consolidation

Consolidating financials across subsidiaries or regions is one of accounting’s most complex tasks. Agents handle this automatically by matching intercompany transactions, preparing elimination entries, and consolidating balances. They maintain accuracy across currencies, entities, and ownership structures without requiring spreadsheet coordination.

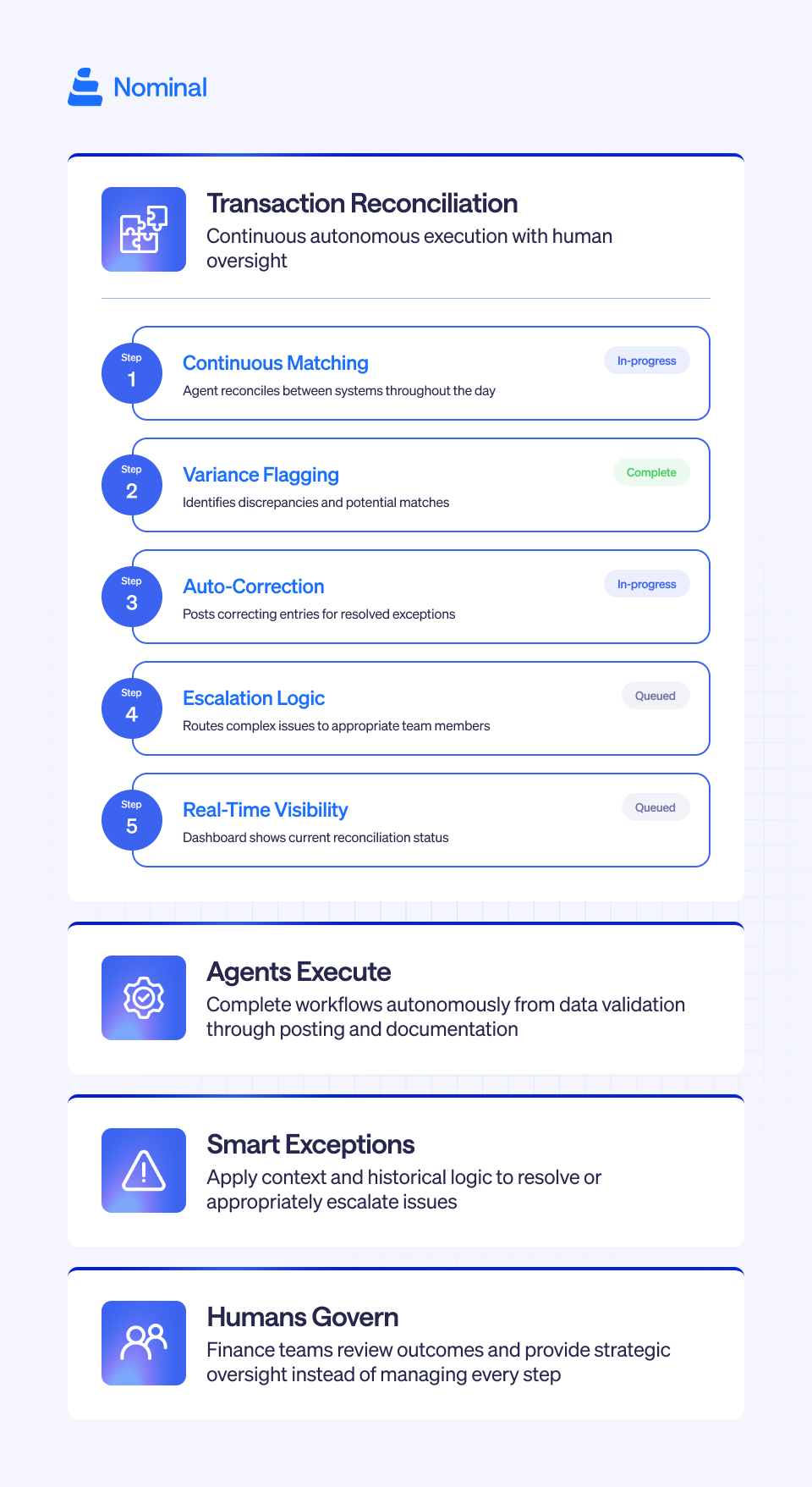

Transaction Reconciliation

When transaction volumes grow, manual reconciliation becomes impossible to sustain. Agents reconcile continuously between systems and accounts, flag variances, and post corrections. They remove backlogs and maintain up-to-date visibility without waiting for month-end.

In every case, the agent executes while humans supervise outcomes. This creates a hybrid model where automation carries the workload and professionals focus on governance and analysis.

The Organizational Shift

Adopting Agentic Performance Management changes more than processes. It reshapes how finance organizations scale, operate, and create value.

Scalability without new hires

Traditional models expand linearly with headcount. Agentic operations scale instantly as complexity grows. Finance teams can support new entities or business lines without proportional staffing increases.

Recommended read: How to Scale Finance Operations Without Adding Headcount: Data-Driven Insights from 50 Million Transactions

Elevated finance roles

When agents handle execution, accountants focus on process design, performance analysis, and decision support. The work becomes more strategic and rewarding, improving retention and engagement.

Real-time visibility

Agents operate continuously rather than in monthly cycles. Finance leaders gain instant insight into performance, exceptions, and emerging risks, enabling proactive decisions instead of retroactive analysis.

Consistency and reliability

Agent-driven workflows deliver the same quality every time. Close timelines become predictable, results remain stable, and operations continue smoothly regardless of personnel changes or peak workloads.

This model turns finance from a reactive function into a continuous system of performance management.

Why This Category Exists Now

The technology enabling APM did not exist until recently. Previous automation relied on rigid rules and predictable data structures, which collapsed under variation. Early AI models could reason about data but lacked the ability to act autonomously within enterprise systems.

Recent breakthroughs in AI reasoning, data integration, and exception handling have changed that. Autonomous agents can now interpret accounting data, learn from feedback, and adapt to real-world conditions. Combined with deeper connectivity across ERPs and subledgers, these capabilities make continuous execution possible.

At the same time, operational pressure on finance has reached its peak. Teams face tighter timelines, higher transaction volumes, and increasing compliance demands. Doing more with the same resources is no longer sustainable. The timing for agentic execution could not be better.

How to Start Implementing APM

Introducing Agentic Performance Management begins with identifying the processes that consume the most time yet follow repeatable logic. Multi-entity consolidation, intercompany reconciliation, and standard close procedures are ideal starting points.

Next, deploy agents alongside the existing team. They handle execution while humans manage exceptions and approvals. This phased approach delivers quick impact while building confidence in autonomous operations.

Finally, measure operational results, not just adoption. Track metrics such as days to close, reconciliation backlog, and time spent on manual entries. The improvement in efficiency and visibility becomes clear within the first cycles.

Helpful resource: Finance Doesn’t Need More Tools, It Needs Agentic Performance Management

A Smarter Model for Modern Finance

Agentic Performance Management transforms how finance teams work. By allowing agents to execute complete workflows, organizations eliminate repetitive manual work, gain real-time control, and scale with precision.

The finance organizations winning in the next decade won't be the ones with the biggest teams. They'll be the ones running on APM, letting Nominal agents execute operations autonomously while their talent drives actual business value.

Ready to see what autonomous execution looks like in practice? Book a demo to learn how Nominal’s Agentic Performance Management helps your finance team close faster and operate with continuous confidence.